Is the login password on your desktop or laptop computer not working? Forgot your laptop or desktop password? Nowadays computer technology has reached advanced places, There are several ways you can reset the login password to the Windows 7 operating system on your desktop or laptop computer. Today we will learn how to reset login passwords on Windows 7 operating system without any software. Practice the whole article well, the easiest way to reset the password on your computer.

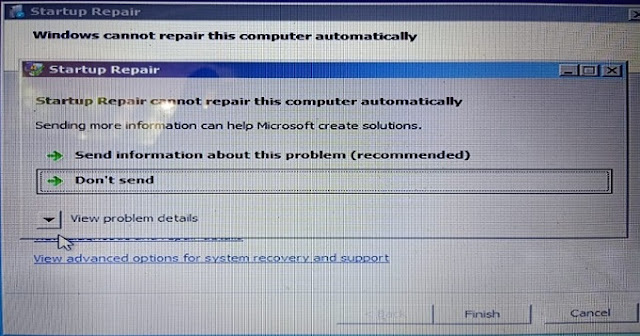

If you suddenly shut down your computer, the following screen shows you have noticed a lot of time, this is where our steps begin.

click launch startup repair (recommended), This startup repair process will find out what problems the computer has. Wait a while and follow the next screen

click on cancel to attempting the repair mode. This time the computer will take at least 5 to 10 minutes to repair.

Click on View Problem Details from the next screen, there will be a link at the very bottom,

Click on the link, This will open a Notepad file on your screen. (X:\windows\system32\en-US\erofflps.txt)

Click on the File menu and click on Open.

This will show the location of your computer's hard disk, Find the folder called Windows on the computer that you have saved to the drive, We usually save our computer software on C drive, If you do, you'll find the Windows folder on your hard disk's C drive.

After opening the folder named Windows, find and open the folder named system32.

The system32 folder contains a file called utilman that needs to be renamed to utilman 1.

Find the file and change the name in the following way which shows in the picture.

Then find the file named CMD here and change its name to utilman.

Then close all the message boxes without saving anything, this will restart your computer automatically.

The next screen shows a logo on the bottom left corner where you have to click.

This will open a command window on your screen where you have to type

control userpasswords2 as it is typed and click the Enter button form your keyboard.

This will show a message box on your screen where you will see the reset password option from which you can set the new password of your choice and click OK.

Now your new password has been secured and changed, you can easily login or open your computer.

I hope I have been able to explain the matter to you through pictures, If you do not understand the subject then you can watch the following video where you will be explained more easily.

Many people can tell you how to crack the password on your computer with a lot of software or third-party applications. Please do not make any mistakes or actions that could harm your security. If you do not understand the procedure mentioned above, follow it again.